Get Pre-Approved in Minutes - Lock in Your Dream Home Today!

faSt, easy, and no obligation - start your journey now

Finding the perfect home starts with knowing your budget. Our quick pre-approval form takes just 2 minutes, and you’ll get:

(1) A personalized loan estimate (no credit score impact*)

(2) A direct line to your dedicated loan officer

(3) Priority access to off-market listings (exclusive for our clients)**

Don’t let another buyer beat you to your dream home!

about us

Constant Support, Ever

Present

We understand that navigating important decisions can be

challenging, which is why we stand unwaveringly by your side.

Our team is more than just

our services

Budget-Friendly Dream Homes

Mortgage Transfer Tax

Fund your dreams

We guide you through the intricacies of mortgage transfer taxes, ensuring transparency and clarity in the financial aspects of your home purchase.

Mortgage Transfer Tax

Fund your dreams

Mortgage insurance, often required by lenders, provides financial protection for the lender in case the borrower defaults on the loan.

Mortgage Transfer Tax

Fund your dreams

It assesses an individual's financial capacity to comfortably manage mortgage payments, taking into account factors such as income.

our mission

Easy Homeownership Access

Pinnacle of Trust

We stand as the pinnacle of trust in the industry. Our unwavering commitment to transparency, integrity, and client satisfaction places us at the forefront.

Easy Homeownership

Guidance at Every Step

Community-Driven Ownership

Whow we are

Confidently Navigate

Homeownership Journey

We understand that the path to owning a home is a significant life venture, and our commitment is to empower you at every step.

ABOUT OUR COMPANY

Why Should You Choose Us?

With years of experience, competitive rates, and a commitment to your financial success, we provide the trusted expertise and personalized service to make your homeownership journey smooth and rewarding.

Purchase New House

Apply For Loan

Refinancing Your Home

Capital Management

Renovation House

Refinance Advisor

WHAT WE OFFER

Our Core Service

Experinces started sit amet consectetur adipiscing elit sed do eiusmod tempor incididunt ut labore et dolore adipiscing elit sed do eiusr adipiscing elitatur liqua

First-Time Homebuyer Loans

Affordable options and guidance designed to help you purchase your first home stress-free.

Refinancing Solutions

Lower your interest rate, adjust your loan term, or access equity with flexible refinance options.

FHA Loans

Ideal for borrowers with lower credit or minimal down payments—backed by the Federal Housing Administration.

VA Loans

Zero-down financing options for veterans, active military, and eligible family members.

Jumbo Loans

Secure high-value properties with customized lending options that exceed standard loan limits.

Debt Consolidation Loans

Combine high-interest debts into one manageable mortgage-backed loan and reduce your overall cost.

BUYING A HOME

We Are Here To Help You

Make it Your Dream

When you own your own homet seeturlit sed dolor sit am

Create A Place

You can grow in your new homeit amet seeturlit sed dolor sit

Be A Part Of Community

Buying a home is an investmemet seeturlit sed

Pay Principal

Gain home equity by paying sit amet seeturlit sed dolor sit

Get Tax Benefits

Take advantage of tax benefitsit amet seeturlit sed dolor sit

Build Credit

Our plan dolor sit amet seeturlit sed dolor sit ameolor sit

WHY CHOOSE US

Among Them, We’re Different

At Los Angeles Mortgage, we combine cutting-edge technology with real human connection. That’s why our clients trust us - not just for one loan, but for a lifetime of financial growth.

Refinancing Your Home: A Smart Financial Move

Refinancing your home can lower your monthly payments, reduce your interest rate, or help you tap into your home's equity for major expenses.

Expert Loan Officers Ready to Assist You

Our loan officers are here to help guide you through the mortgage process, answer your questions, and find the best loan options for your needs.

Your Guide Through the Home Buying Journey

We will navigate you through the complex home buying process, providing expert advice and support every step of the way. Contact us today!

Get Mortgage Quote

Let’s talk about your home financing goals! Book a no-obligation call with one of our expert advisors.

Frequetly Asked Question

Q: What documents do I need to apply for a mortgage?

A: Typically, you’ll need proof of income, tax returns, bank statements, and ID. We’ll guide you through the full list based on your loan type.

Q: How long does the mortgage approval process take?

A: Pre-approval can happen within 24–48 hours. Full approval usually takes 2–3 weeks, depending on the loan and documentation.

Q: What credit score do I need to qualify?

A: We work with a wide range of credit profiles. FHA loans start at 580, while conventional loans usually require 620+.

Q: Can I buy a home with no money down?

A: Yes! VA and USDA loans offer 0% down options. We’ll help you see if you qualify.

Q: Do you offer both home purchase and mortgage refinance services?

A: Yes, we offer both! Whether you're a first-time buyer looking to purchase a new home or a current homeowner interested in refinancing your existing mortgage, we provide tailored solutions to meet your needs. Our team is here to guide you through the entire process—from application to closing—for both purchase and refinance options.

Q: Is it worth refinancing my current mortgage?

A: If you can lower your interest rate, reduce your monthly payment, or tap into home equity, refinancing could be a smart move.

Get In Touch

Email

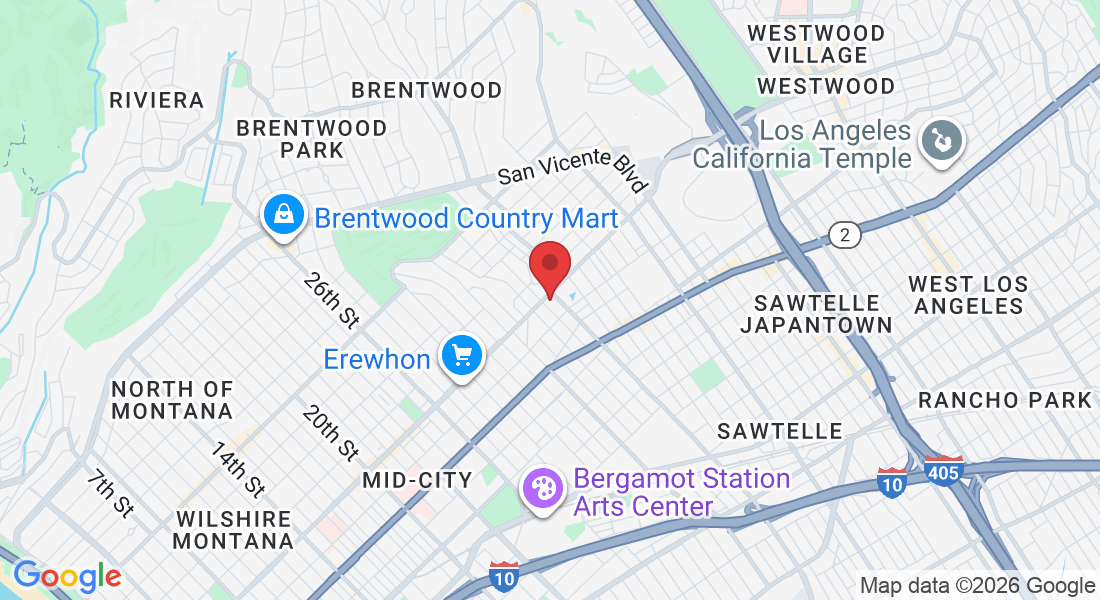

Address

12100 Wilshire Blvd, Ste 800, Los Angeles, CA 90025

Hours

Monday – Friday: 9AM-6PM

Saturday – Sunday: Closed

Phone Number

310-571-5750

Office: 12100 Wilshire Blvd, Ste 800, Los Angeles, CA 90025

310-571-5750